StudybayHelp UK review

This service is a unique platform where freelancers and students from around the world can connect with each other to achieve common results in writing papers for money. This office is very convenient as it excludes participation in negotiations between the writer and the student mediator, which usually takes a percentage for their services.

What is StudybayHelp

Today, this company occupies a leading position in the market of companies that help students in writing various works online. The fact is that the main principle of work of this company is the absolute uniqueness of the written work and maximum guarantees for both writers and students who order these services.

The principal difference of this service from other companies is that the firm annually helps a considerable number of students from around the world to improve their academic performance and pass the necessary work in time. It also contributes to the fact that writers from around the world have a unique opportunity to offer their services without any commissions.

This approach helps all members of this service to get the most favorable offers. In the modern world, studying at universities and colleges is sometimes an incredibly complex process. Though, the student must always have time to pass all the necessary tasks on time and to achieve a certain level of assessment for continuing studies.

Moreover, some of the students do not have the opportunity to devote themselves 100% to the educational process. There are cases when a student needs to provide yourself with additional earnings to be able to pay for studies and support life properly. In this case, the student just needs to find extra work and combine with education. Sometimes this approach does not allow to explore a particular subject fully. When it comes time to write a dissertation or pass a task on a given topic, many of the students face difficulties in doing so in a due degree well.

For such cases, it is worth using the help of professional writers who not only know how to write such works but also understand how they should be designed and what sources of literature should be used. In fact, clients take the load off their shoulders and provide an opportunity for real experts to do their work professionally.

How really does StudybayHelp work?

Since this company works both for writers as well as for students, it is worth considering its processes in more detail. Some detailed analysis helps to more clearly understand how this or that order process looks at the company to facilitate both the order itself and the understanding of how to do it correctly.

How it works for writers

In order for a writer to be able to take one or another order for execution, it is worth going through the registration procedure on the web site. The procedure is quick and does not take a lot of time from the author. To do this, one should go to the site and proceed with the registration procedure. The procedure itself may look like this:

- Creating an account on the company’s website;

- Making the necessary information (level of education, a diploma of higher education, additional knowledge, and skills);

- Sending an application for verification;

- Confirmation of the application by the service;

- Access to the database of orders;

- Taking orders and getting started.

How it works for clients

Most often, as soon as a student receives a task, one must visit the web site if you do not have an account created yet, go through the quick registration procedure. In order to go through the procedure, the client will need to proceed with several simple stages, namely:

- Go to the website of the company;

- Press the Login button;

- Enter the necessary contact information about yourself;

- Provide the necessary financial information to deposit funds into the account further;

- Create a request for a specific task;

- Give all the information about the work and attach all the necessary materials to work;

- Send a request to the exchange;

- Get quotes from authors.

How to write a review for StudybayHelp

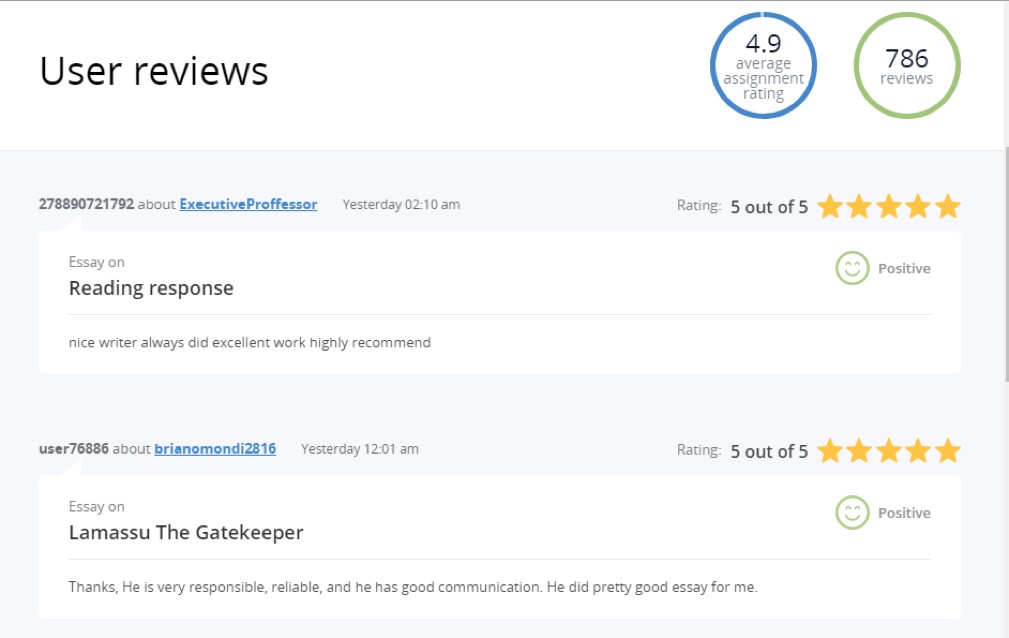

Writing reviews about the firm is very important for both students and writers. The fact is that this, in turn, helps other users of the service to make a more competent and balanced decision about the choice of the author and the use of other services of the company.

For students

After completing one or another assignment, you will have the opportunity to leave StudybayHelp review about the writer who did your work. If the author did the work correctly and everything was done well, then it is imperative to leave feedback about this writer so that other clients can see high StudybayHelp reviews rating and often use the services of trusted authors. Thus, good authors will always be in sight, and bad authors will be automatically eliminated after the student has received suggestions for the possible performance of his work.

For writers

Getting positive StudybayHelp jobs feedback directly affects the number of clients and earnings of a particular author. As soon as clients see high ratings of the writer as well as positive reviews of his work, such writers are usually approached more often and with great enthusiasm choose them to do the work.

The company is formed in such a way that the final choice will always be often based on the number of positive or negative reviews about a particular author. As well as the levels of written work and various points about the edits and formatting of the final version.

Does anyone knows where is StudybayHelp located?

When a similar service is functioning online, it does not need any particular anchor point. Such an approach is justified in the case when authors and students are not residents of any particular country or city. Thus, students from all over the world can get help from the most experienced and competent writers who live in completely different countries, however, have the opportunity to help anyone write scholarly and unique work with a high level of quality.

Is StudybayHelp legal in the Great Britain?

The activity of this service in any country of the world is not recognized as illegal. The company does not provide direct services to either the writer or the students. In fact, it is only a platform where students and writers can communicate directly and thus help in achieving the necessary results in the educational process.

This company always notifies its customers and contractors of all working conditions and timely payment. Thus, this service does not hide anything from its customers, but rather contributes to the relationship between the writer and student as open as possible. The activity of this firm is absolutely legal not only in the UK but also in the USA and other countries of the world.

How are companies like Studybay Help legal

If we consider the activities of this company from a legal point of view, the solutions that are provided on the service itself is not something illegal. The opinion about how is StudybayHelp legal most often arises from teachers of educational institutions or parents of students.

The point is that both of them are most interested in the fact that the student receives knowledge independently. Their how legit is StudybayHelp opinion implies that the company helps students too much, as a result of such help, students can simply become lazy and stop performing absolutely all tasks.

Of course, there is a risk that the student will want to completely switch to the services of this web site since they are very accessible and easy to use. Nevertheless, it should be understood that this is only the opinion of teachers or other people who do not want the life of a student to become somehow easier. For this reason, they often arise a question StudybayHelp is legit?

As for the legal point of view, here it is necessary to consider this service from a little bit another side. All information about the activities of the company is fully spelled out on the web site itself. They mean that the service is most interested in ensuring that students receive a unique material with a specific deadline. These conditions are spelled out in great detail and therefore exclude any illegality.

As for writers, their activities are also entirely thoroughly described in the rules of interaction with the website. Thus, we can see that the firm initially shows all the conditions of possible cooperation between the author and the student where both parties must agree before starting the cooperation. There are no particular reasons to ask is StudybayHelp legal.

If we consider websites that write essays for you, then there are no such rules that prohibit them. It should be seen as directly assisting the student in the learning process. From this point of view, this is absolutely acceptable. Moreover, each of the materials made is not plagiarism because it has the highest degree of uniqueness. Thus, neither the student nor the writer violates any rules and copyrights.

The activities of this company, as well as the activities of other similar companies in the market of writing works for money, have their positive and negative sides, which are also worth mentioning.

Advantages of using it

As it was already mentioned, all services that work as part of writing for money have their own advantages and disadvantages. This company is actively working to increase the level of service delivery to the maximum. Nevertheless, it is worth noting the following positive aspects of the service:

- Short deadlines

- Cooperation between the author and the client does not provide for the participation of intermediaries and has zero commissions.

- All communication between the author and the student takes place directly

- The client is always able to choose among a large number of authors and their price bids

- After completing the dissertation, the client has a 20-day period for absolutely free amendment of changes to the work

- Guarantees from the service regarding refund and the level of uniqueness of work

- A good level of technical support for customers and performers

- No restrictions on the subjects and the degree of difficulty for which the task is performed

- The lowest price among all companies of this kind in the market

- The opportunity to use the services of authors from around the world

- A large number of orders for writers

- Terms of work are spelled out to the maximum that eliminates problems with the final version of work.

Is it true that StudybayHelp scam?

In order to fully answer this question, it is necessary to understand that this company is the leader in the market of academic writing services uk. Thus, this wording absolutely completely excludes the fact that the company may be fraudulent.

The company’s web site has been operating for a long time and has the highest ratings among clients and writers on the Internet. Moreover, the company continually invests heavily in the development of the site itself as well as technical support to customers and writers to ensure the highest level of their services. Thus, this completely excludes from the fact that the company may be fraudulent.

Most often, fraudsters organize companies that operate for a short amount of time and try to deceive the maximum number of clients for a short period and then disappear. Such companies are often called ephemeral. Moreover, the service does not have any commissions from writers, which in turn proves its honesty and openness.

Also, the company’s website provided all the necessary documents and indicated the place of registration of the company. In turn, fraudsters never show such information and try to hide it. So we can safely conclude that the company’s activity is absolutely legal and open. Otherwise, it only could not become the most popular company in the market.

If anyone still doubts whether is StudybayHelp legit, please look through the web site of the firm in detail, you can make sure that the company is registered in Malta and the management company is EDUTEC LIMITED, and it doesn’t hide this info.

Quality essay on the StudybayHelp UK

If we analyze the quality of reviews written by students on this site, we can conclude that the level is quite good. Again, the fact is that there are too many different authors on the site, and of course, there are cases when students come across a not quite professional writer.

The essay website informs customers more than once that the choice of a writer is an extensive process which is worth concentrating on. If a student wants to get a unique work that is done without grammatical or spelling errors, then one should carefully choose who you are assigning this work to.

Despite the fact that there are reviews that some of the works do not correspond to the stated quality and were not always completed on time, most often, the reason is the low level of the writer. Therefore, it is mainly necessary to understand that it is not the right decision to look for the cheapest paper bid, but in turn, focus on obtaining high-quality material.

Each task that is performed online for money has several sides, both positive and negative. Nevertheless, the advantage of the site is that the student can choose who will write an essay and, accordingly, roughly imagine the level of its quality and uniqueness.

Guarantees on the StudybayHelp UK

One of the main advantages of working with this company is that it provides guarantees both for the uniqueness of the work and for a refund in case of any problems. It should be understood that both writers and students work on the service, and thus guarantees should apply to both parties.

In other words, both the author and the student should be protected in case of any disputable situations. If we consider feedback on the work of the service from both the students and the authors, then most often there are questions about the finished work. Though the company always tries to competently understand the situation and make the right decision about its resolution.

Guarantees for students

Since the service does not directly fulfill the obligations to the students to write the works, it is mainly guaranteed that are focused on correctly regulating the relationship between the author and the customer.

Such guarantees include:

- The company does not take money from the client until the work is completed in full;

- A student has a 20-day period after the work has been completed during which it is possible to analyze the work for uniqueness and lack of grammatical and spelling errors and also suggest the author make the necessary edits;

- The money will be transferred from your account only when you agree that the work was done qualitatively;

- If in the process of performing the work the author defaults, money can also be returned to the student;

- All customer contact information is strictly confidential and cannot be disclosed to anyone.

Guarantee for writers

The service also gives solid guarantees for authors, and they are as follows:

- Money is transferred to the writer immediately after the work is completed and fully verified;

- The company provides zero commissions from the authors;

- If a student wrote an unjustified negative review, the company undertakes to consider the situation to correct it ASAP;

- After the end of the 20-day period, the student has no right to refuse the work performed, and the money will, in any case, be transferred to your account if the work has been completed in full.

Prices on StudybayHelp for England

The most important advantage of the work of this service is that the student can independently determine the value of his/her work. To adequately assess how much one or another task can cost, it is worth referring to an online calculator which is placed on the company’s website. Thanks to this, you can understand what an adequate financial proposal you can make for all writers.

We draw your attention to the fact that you should not choose the cheapest writer, because later you may be faced with inferior quality work. Accordingly, you will lose precious time and will be disappointed. For this not to happen, you need to understand that good work cannot be incredibly cheap.

Also, pay attention to the level of training and education of the author. Among the writers on this resource, there are also very professional people who have vast experience in writing certain types of work and their high reviews prove that to that fullest.

How is the order price on the site

It is appropriate to understand what can affect the final cost of your work. The point is that the cost of each particular work depends on various factors, including:

- The subject for which the work is written

- The amount of work in the pages

- Type of work required

- Terms of work

That is why to find out the specific value of your work, and the easiest way is to use the online calculator on the web site. In turn, after you post the task and offer the cost for its implementation, you will receive a huge number of proposals from authors from around the world. Carefully read the reviews about how one or another writer completed similar tasks and what result customers received in the end. Such detailed information will help you quickly and competently choose the author and ensure good results of your work.

StudybayHelp promo code

Since the services of this company on the Internet are very popular, there are a considerable number of companies that offer StudybayHelp promo code for its services. Such coupons are an essential tool, especially for those customers who want to write a large volume of work. This tool will help any client save a significant amount of writing an essay. To date, there are various types of discounts that will help optimize the funds necessary to perform a particular job. These StudybayHelp coupones can start at 5% and up to 50%.

How to use StudybayHelp?

In order to more clearly understand how exactly the service of this company works, it is necessary to consider its activities for both customers and performers. In this way, both parties will be able to imagine what steps will be necessary to go through to get the desired result.

How does StudybayHelp work for writers

Every month the company attracts a huge number of writers from around the world. For performers to properly perform their duties, it is necessary to clearly understand how the whole structure looks from the moment of registration until the moment of receipt of money.

Get registered and approved

Before you start your activity on the service website, you will need to go through a simple registration procedure. To do this, you need to go to the company website and register. During the registration process, you will need to provide all the necessary contact information, as well as indicate the current level of your education and specialization. Then your application will be sent to the management of the company. Consideration of the application does not take a lot of time.

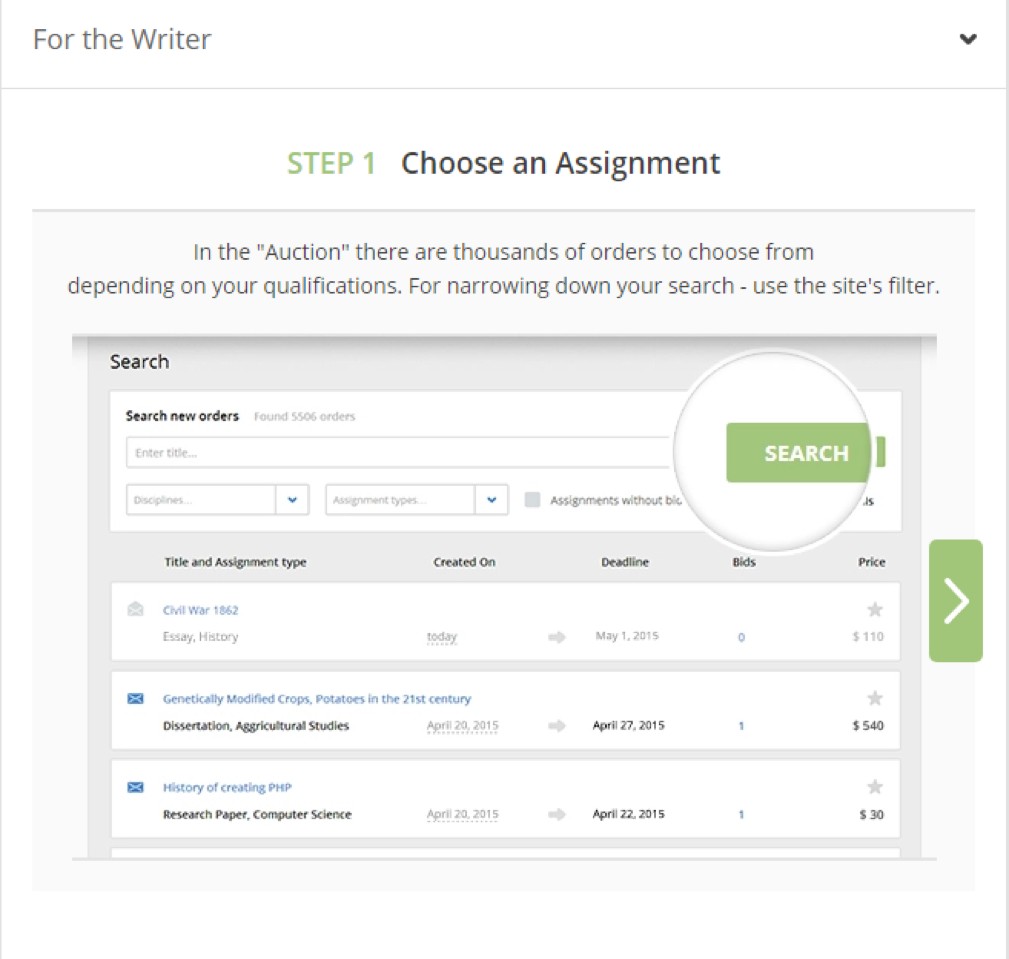

Get full access to customers’ data base auction

After your application is approved, you will automatically receive an email notification, and you will have access to the auction of students’ orders and offers.

Read through the task details

As soon as you find suitable tasks for yourself or you are interested in a specific offer, you will first need to review all the details and requirements for the task. If everything suits you, you can agree with the implementation of this work

Proceed with your price offer

In order to continue, you will need to make a response price quotation to the customer and, if you wish, write in the comments your experience in writing such works or why you think this work should be entrusted to you.

Get notified about your bid and confirm the task

After you send your proposal to the customer, you will need to wait for a while until an email notification from the customer comes to your mail. From now on, you will have 12 hours to confirm your intention to complete the work.

Work with student’s suggestions

In the process of doing the work, students most often track this progress of work and suggest making several edits and changes to its structure. Therefore, at this stage, it is vital to fulfilling all incoming proposals from the students, since when the work is ready, there will probably be no need to make additional edits and it will initially meet the requirements of the student.

Upload the task to the service website

Once the work is written in full, you will need to upload it to the site of the company itself. This solution helps you to protect yourself from the fact that the student can download the work and not transfer your money for the services rendered. Thus, after the work is uploaded to the web site, the so-called 20-day period begins during which the student can recommend you make changes and edits to work and correct errors if any.

Receive your payment

After the end of this period, the money will be immediately transferred to your account. After that, you can withdraw money in any way convenient for you.

How to use StudybayHelp for students

The process of ordering an assignment for students also looks quite simple. And the easiest way to present it is in the form of some steps at the end of which the client receives a finished paper with all the requirements fulfilled.

Specify the task

This stage is important as the customer will be required to provide the most accurate and detailed information on their task. If any part of the task or the details are missed, then most likely you will get a result that will not meet your expectations. Thus, be very careful and provide all the materials on the work and your additional requests. Of course, you will be able to make edits to the writing approach. It is better to set the vector for correct essay writing initially.

Receive bids from writers

Once you have specified all the necessary requirements, you will need to bid for the performance of a particular task. After you do this in a short time, a large number of proposals from authors from around the world will come.

Choose the one you like (pay attention to reviews!)

It is necessary to consider as much as possible all the proposals received. Again, you should not chase the lowest price because most often, the author who offers such a price will not be able to complete the work according to your expectations. You should also carefully read the reviews about a particular writer and about positive or negative experiences in writing such works. This way, you can protect yourself from any disappointments in the future about the results of your assignment.

Fund your account

As soon as you know the final cost for an essay, you will need to deposit the appropriate funds into your account. This company provides various options for how to transfer funds to your account. Among the possible methods, there may be a transfer with the help of:

- VISA;

- MasterCard;

- Payoneer.

After you have transferred the required amount to your account, you will need to select a specific writer and notify you that you are submitting the task for implementation.

Check the process and suggest edits

It is essential to keep track of the process of doing your project and to make all the necessary edits. The service provides an opportunity for each student to receive draft versions of your work and see initially whether it requires editing or not, as well as to make sure of the level of uniqueness of the written paper.

Look through the draft and ask for edits if necessary

As soon as the work is written, you will face a 20-day period in which you can make a detailed analysis of your work, check its uniqueness and the absence of any errors and omissions. Carefully check your work for double spaces and grammatical errors.

Review your writer

After making all the edits and getting the finished work, it is highly desirable that you leave a review of your writer on the site. Thus, other customers will be able to assess in advance the possibilities and level of training of one or another specialist and decide whether to use him/her to complete their assignment.

StudybayHelp account

If you are for the first time on the company’s website, you will need to register your own account before starting work.

StudybayHelp account for writers

This procedure is absolutely necessary since, at this stage, the company should receive information about your education and also understand what types of work you are ready to perform. You will need the following information in order to understand how to login in the future:

- Your contact information;

- Your education and skills;

- Information about where to transfer money for work done.

H3: StudybayHelp login for students

After completing the registration process, you will create your own account and be able to enter all the necessary information about you and your work. Also, one should understand that the company does not require you to provide a large amount of information for registration.

- Most likely, you will need to provide the following information:

- Your email;

- Additional finance information on how you are going to deposit funds to the account.

StudybayHelp wiki

If you have any additional questions, then in this section you can find answers that will help you to understand the service properly.

How do I close my StudybayHelp account

You can do it using your personal account, or you can contact support for more details and complete guide.

How long does accreditation take on StudybayHelp

It doesn’t take long. Generally, it can take up to several hours.

How much does StudybayHelp charge for service and commission fee

The firm provides NO commission.

How reliable is StudybayHelp

It is very reliable, though large work should be done with choosing an author though.

How to become a writer in StudybayHelp

Enter the website and register your account. After you receive approval from service, you can go on with earning money.

How to become a writer on StudybayHelp

Send your application and after approval and can kick off.

How to choose a good writer on StudybayHelp

Look through all reviews and try to figure out his/her experience in a task you need to complete.

How to create StudybayHelp account

You need first of all to visit the service website and proceed with registration.

How to delete StudybayHelp account

Contact the support for a detailed guide.

How to hire a writer on StudybayHelp

After receiving bids, you need to check the most reviewed writers and pick up the one.

How to cancel order on StudybayHelp

Depends on a stage of your order, so simply describe the situation to support and get the detailed answer.

How to join StudybayHelp

Register your account on the firm web.

How to open a website like StudybayHelp

Use any search engine and write there Studybay, after choose the first one variant of search and click there.

How to pay StudybayHelp

You can use these options: VISA, MasterCard, or Payoneer.

How to send invitation on StudybayHelp

Use your personal account for that option.

Why wont my card payments go through StudybayHelp

There can be lots of reasons, but the most common one is wrongly filled in details. Check them once again or contact support.

Pros and Cons of the StudybayHelp

It should be understood that this company has both positive and negative sides. Thus, this service provides the most optimal services for writing various types of work online. Among all the services of this type, this firm is the most popular on the Internet. However, it also has its drawbacks.

Pros

The pros are excellent here, and they are handy anyway for both writers as well as clients.

- A large number of proposals from different authors from around the world

- The money will be withdrawn from the client’s account only after the work is completed in full.

- The possibility of making only part of the payment before the assignment

- The ability to make changes in the framework of writing

- Guarantees from the company for both students and writers

- Complete anonymity of your data

- The ability to independently set the price task

The cons are something you need to take into consideration.

Cons

- The minimum period of work 24 hours

- A large amount of time is spent on sifting out low-quality offers.

- Lack of multi-channel phone for customers